Commercial Property Finance & Commercial Mortgages

Commercial property finance for property investors and business owners.

Investment Property Partners is a leading independent property investment specialist advising clients throughout the UK and internationally. In addition to our property investment services we offer a range of complimentary commercial property finance, insurance and professional investor support solutions.

Commercial Property Finance

Commercial property finance describes finance used for the purchase of commercial real estate or the re-financing of existing loans on property used specifically for commercial purposes such as offices, shops and industrial premises.

Commercial property finance or similar commercial mortgages should be viewed as a long term form of finance and are usually offered for a term of 15 years or more.

Commercial property mortgages are similar in many ways to domestic mortgages in that the property to be purchased is used to secure the loan, and the lender retains a legal claim over the property until that loan is repaid in full.

Interested in Commercial Property Finance?

If you’d like to learn more about our commercial property finance and property investment capabilities and how we can help you, if you’d like to receive information about investment properties for sale, including the latest new developments and off-market investment opportunities, or if you’d like to discuss your requirements in more detail please contact us today:

Suitable Commercial Property Types

Examples of properties, which should ideally be freehold or long leasehold, that are suitable for this form of commercial property finance include:

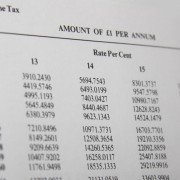

Loan to Value & Interest Rates for Commercial Mortgages

For commercial property mortgages, the maximum loan to value (LTV) amounts available are typically between sixty and seventy five percent but may be less under certain circumstances, depending on a number of risk factors including the type of property available as security.

If additional security is available from the borrower, say in the form of another property, then a full financing option may be possible.

Interest rates on commercial property mortgages can vary considerably and will usually be based on a number of risk factors including the type of business, its track record and personal standing and status of the applicants.

Fixed & Variable Rate Mortgages

There are two primary types of mortgages available when considering commercial property finance, the fixed rate and the variable rate mortgage.

A fixed rate commercial mortgage has an interest rate that is consistent for the full term of the mortgage and will therefore not change as economic conditions and other interest rates fluctuate.

The benefit with this form of mortgage is that all future interest payments can be predicted with certainty allowing businesses to plan ahead with more certainty.

A variable rate commercial mortgage has a floating interest rate that will change based on figures released by the Bank of England.

This means that the borrower will pay different interest amounts as the market rate fluctuates.

Specialist Commercial Property Finance Solutions

As a leading independent property investment specialists Investment Property Partners offer expert advice and support to clients across our specialist areas of expertise helping them to achieve their investment objectives.

If you are a property investor, business owner or developer looking for specialist commercial property finance solutions please contact us today to discuss how Investment Property Partners can help you.

You may also be interested in…

Further reading…

More information about commercial property finance and commercial mortgages… here →

REVIEWS

Submit your review here

You must be logged in to submit a review.