Capital Gains Tax on Property Disposals – Guide for Property Investors

As a prudent property investor one thing you have to be wary of when you dispose of any property such as a building, land or a lease – whether you sell it, give it away, transfer it to a third party or exchange it for something else – is Capital Gains Tax.

The UK’s HM Revenue & Customs (HMRC) describe Capital Gains Tax as a tax that is payable on the profit or gain you make when you sell or dispose of an asset such as land or property.

Disposing of an Asset

You usually dispose of an asset when you cease to own it – for example if you:

Always remember that it is the financial gain you make from the transaction and not the amount of money you receive for the asset – that is taxed.

For the latest guidance on Capital Gains Tax and how it affects property investors selling or disposing of property assets you should visit the HMRC website… HMRC →

What Types of Property are Subject to Capital Gains Tax?

So what, you are entitled to ask, are the types of property which may incur such a tax?

Typical examples are a property that you have bought as an investment – buy-to-let for instance – a second home, either in the UK or overseas; business premises; or land.

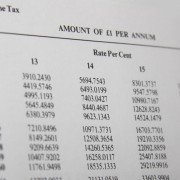

Calculating the Capital Gains Tax Payable on Property Disposals

Having established which category fits your property you then have to work out how much Capital Gains Tax you might have to pay when you sell or dispose of your property.

It is the financial gain you make from a transaction and not the amount of money you receive for the asset on disposal that is taxed.

You need to look at each asset disposed of that is liable to Capital Gains Tax and then work out separately each gain or loss; add together the gains and take away any losses; deduct your tax-free allowances; and work out the tax due on the gains that remain.

Paying your Capital Gains Tax

So how do you pay your Capital Gains Tax?

In the UK you do it through the HM Revenue & Customs Self-Assessment system, and it is calculated as part of your Self-Assessment tax return.

If you do not receive a letter telling you to complete such a return you should tell HM Revenue & Customs because you may have to pay a penalty if you do not.

Always make sure that you file any records and information that might help you work out your gains and losses.

Capital Gains Tax and your Family Home

Be re-assured, however, that normally you do not have to pay Capital Gains Tax when you sell or dispose of your own home, as you will probably be entitled to “Private Residential Relief”, which may exempt all, or at least part, of any gain you may have made.

What about Transferring Property Assets to Family Members?

Again, if you sell, give or dispose of a property to your husband, wife or civil partner, you do not normally have to pay Capital Gains Tax, although you must have lived together for at least part of the tax year in which you made the disposal.

However, if your husband, wife or civil partner then sells or disposes of the property at a future date, they will have to work out the tax due.

It is therefore advisable that you keep a note of what the property cost you, as it may be needed to work out Capital Gains should it be disposed of later.

Bear in mind this applies only to a spouse or civil partner.

If you dispose of your property to any other family member you will have to work out whether or not you made a gain or loss and if there is any Capital Gains Tax due.

Some people give away their home, usually to a son or daughter, and if you decide to do this there is not usually a requirement to pay Capital Gains Tax as long as you are entitled to full “Private Residence Relief”.

You should make the recipient of your gift aware, however, that they may have to pay Capital Gains Tax if they sell or dispose of it in the future.

Property Tax, Property Investors & Developers

So we come to property trading, professional property investors and developers.

If you buy and sell property as your main business you pay Income Tax rather than Capital Gains Tax on any profits you make from the property transactions you undertake.

If you are a director or shareholder in a company which is involved in property trading activities, any profits on properties disposed of are part of the company’s profits and it is the company which will pay Corporation Tax on its profits.

As for when you dispose of land rather than property, in many cases you will need to work out the gains and losses in the same way, but there are special rules for working out gains and losses if you dispose of land that has been the subject of a compulsory purchase order; if you grant a lease; or if you assign or surrender a lease.

So do check out those rules if the situation applies to you and seek specialist tax advice.

Overseas Property & Capital Gains Tax

One important question that is often asked by clients is:

If I own a property abroad am I still liable to pay Capital Gains Tax when I sell it?

The answer, if you are resident in the UK, is yes.

Whether it be a holiday home abroad; a property that you let; or land that you have bought for development, you will have to pay Capital Gains Tax on the profit element of the sale.

However, you will be pleased to know that if you are resident in the UK and not merely domiciled here, you will be able to claim what is known as the “remittance basis”.

When you start talking about residency, domicile and tax on foreign gains it does become complicated, because no two cases are ever completely alike, so we always recommend that you seek expert tax advice to help in such situations.

Keeping Detailed Financial Records

In all instances, as a prudent property investor you should keep detailed financial records so that you can work out whether or not you have made any capital gains, or you have any suffered financial losses associated with your property ownership.

Such records will help you fill in your tax return and will be invaluable if there are any queries to answer from HM Revenue and Customs.

So again, research carefully what kinds of records you need to keep.

You need, for example to know exactly when you acquired an asset, owned it and disposed of it; how long you need to keep records after you have sold the property or disposed of it in some other way; and always be aware of what course of action you need to take should your records be lost or destroyed.

As in all things, the more you know about a subject the greater will be your chances of making a success of your venture, and the same applies to property investment and Capital Gains Tax.

With all the information at your fingertips you will be better equipped to optimise your tax position.

Specialist Property Finance & Support Solutions

As a leading independent property investment specialists Investment Property Partners offer expert advice and support to clients across our specialist areas of expertise helping them to achieve their investment objectives.

If you are searching for commercial property valuation assistance or investment and financing solutions please contact us today to discuss how Investment Property Partners can help you.

Further reading…

More information about Capital Gains Tax on land and property assets visit the UK’s HM Revenue & Customs (HMRC) website… HMRC →