Life Changing Experience

Investing in your very own UK holiday home will no doubt be an exciting and life-changing experience that you should thoroughly enjoy.

However, whilst retaining your enthusiasm is vital throughout the journey, you should also remember to keep a clear head and remain calm in times of stress, as climbing the property investment ladder takes hard work and patience… in many ways, the work never stops.

Generally though, if you get good advice and keep your wits about you, you will certainly reap the rewards of a wonderful addition to your lifestyle and more importantly, your financial standing further down the line.

Your Investment Strategy

It is important to recognise that even though investment in holiday homes/the second home property market may appear to be a tempting prospect, there is so much more to just collecting the rent.

Investing in a holiday home in the UK or abroad can be hard work, and in some cases it can take years to deliver exactly what you originally had in mind.

Buying a second home can also be an extremely expensive mistake to make if you don’t get your investment strategy right from the outset.

With this in mind, you should first of all take time out to identify exactly what it is you want to achieve from your investment, decide how you propose to manage it and ultimately whether or not your finances will allow it.

Later on, we will highlight some of the major pitfalls that you should look to avoid and we’ll also outline a few tips to help you on your property investment journey.

Firstly though, we’ll discuss the all-important benefits of owning a holiday home.

Benefits of Holiday Home Ownership

Investing in one or more holiday homes is something most of us can only dream of – yet with around half a million holiday homes in Britain alone, there are plenty of people who have taken the plunge and are now enjoying the financial and lifestyle benefits this kind of investment can bring.

Good Rental Yields

One of the most positive aspects to the holiday rental market are the rental yields that can be achieved from your investment.

For instance, rental returns for good, well located holiday property can be almost double that of typical buy to let properties, and in the right location people will always pay that little bit more to get what they want.

Investing in a holiday property can also be seen as a second income for many people, so that should you lose your main source of income, you will still have a steady influx of cash to tide you over.

Boost your Pension

Good holiday property investments are also likely to benefit from capital growth over time and can be utilised as an effective second pension for many of us… for more information on pensions you should speak to a qualified pension’s advisor.

Your own Holiday Getaway

Aside from the property earning you money, holiday homes are also a great “bricks-and-mortar” asset that you can use time and time again for holidays, week-end breaks and time away with friends and family.

Tax Benefits

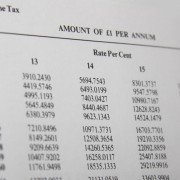

Finally, there are also some good tax benefits that potential UK holiday home investors should be aware of.

Because the UK taxman currently treats holiday rental properties as businesses, there are some great advantages that you may not be aware of, and which may ultimately sway your decision.

This is just the tip of the iceberg and you may find that you are entitled to more benefits as you investigate this form of property investment further.

Fluctuations in Rental Income

Be aware that demand for UK holiday homes usually fluctuates throughout the year… for instance, your property may be in great demand at Easter, Christmas, during school holidays or during the summer months, yet you will find that outside of these periods, or when the weather is particularly poor your holiday home may be left vacant.

Ask yourself…

Can I manage and balance these fluctuations in my cash-flow?

Am I financially sound enough to be able to cope until the peak time’s return?

These are points you need to consider carefully when developing your financial strategy.

On-Going Costs

You should also be aware of the hidden costs of holiday home ownership – which can be substantial.

Just like purchasing your main family home, you need to plan and prepare for any unforeseen maintenance costs.

You should also take in to account local council tax charges and any managing agents fees – that is if you’ve decided to outsource the letting and day-to-day management of the property to a local agent.

The cost of furnishing and repair work and the expense incurred in advertising the property will also need to be factored in to your calculations.

Buying your UK Holiday Home

After researching your location and the properties available, getting to grips with the pitfalls as well as the benefits of holiday home ownership, you should now be fairly confident in your ability to make an informed decision on whether to buy or not.

If you still want to press ahead and make your holiday home purchase as straight forward as possible, you should always remember a few basic rules and follow them when reviewing any properties of interest.

Firstly, make sure you calculate your budget and what you want from a property, and then make a checklist of these points and arrange your viewings accordingly.

Once you have decided on a property and your offer has been accepted, you should then get legal advice and professional surveys completed before signing any contracts.

Once these tasks are complete and everything is in order, it’s time to hand-over your deposit and get the ball rolling.

Understanding the Holiday Lettings Market

Of course, some holiday properties will market better than others.

For instance, a two or three bedroom house or apartment will be better for families and groups of friends, so you may get more interest from this sector of the market.

Another useful hint if you want to be successful in the very competitive property game is to keep your property looking in tip-top shape both inside and out.

Also remember, first impressions are everything, so a well maintained garden and a homely and welcoming feel on entering will set you apart, and will undoubtedly provide you with more repeat customers.

Managing your Holiday Home

One of the most important things you need to realise with any property investment is the amount of effort you need to put in to make it successful.

If you are managing your holiday home yourself remember you will have to deal with marketing, new lettings, tenants, rent collection, cleaning and repairs on a regular basis, so you should be prepared to utilise a whole range of skills and deal with the paperwork that comes with it.

The administrative burden of managing your property can sometimes bog you down if you don’t keep on top of it – so bear this in mind.

You should also speak to local letting/managing agents to see what they can do for you, especially if you don’t live locally.

Property management fees tend to be around fifteen per cent of the rental income, but this for some people proves more than it is worth.

Also, always remember to have your property properly insured taking in to account that it is a holiday let, and that it may be vacant at various times throughout the year.

Location, Location, Location

Finally, remember the old adage… location, location, location.

A popular holiday area offering good facilities, local amenities and plenty of sight-seeing opportunities will always do well.

Expert UK Holiday Home Investment Solutions

As leading independent property investment specialists Investment Property Partners offer expert advice and support to clients across our specialist areas of expertise helping them to achieve their investment objectives.

If you are a property investor seeking to acquire or dispose of a UK holiday home or second home contact our UK property investment team today to discuss how Investment Property Partners can help you.