Financial Benefits of Buy to Let Property

Typically, buy to let properties should be seen as a longer term investment that when compared to other forms of financial investment can provide excellent returns.

In the UK the buy to let property sector is an excellent area of opportunity for property investors looking to get their hands on a regular income, it is also a great way to build a property portfolio.

It is also acknowledged that buying a property to rent out can benefit you, the landlord in two key ways.

Firstly, a buy to let property can produce a steady income without having to do very much, and secondly it offers the potential for long-term capital growth.

For many investors who have already experienced the benefits of buy to let property, there is no sounder investment to be made.

It has the potential to allow you to retire early, and is an area of investment that will enable you to leave your loved ones something behind when you’ve gone.

In terms of figures, buy to let property certainly speaks for itself.

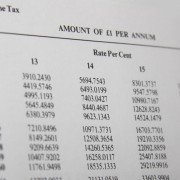

Before taking into account all the costs of letting, the gross return on investment you can expect to achieve will typically be between 7 and 10 per cent (plus), and the rental income that you make should be approximately 130 per cent of the monthly mortgage repayment – as a minimum.

Buy to Let Property Market

The buy to let property market hit its peak just before 2007, yet shortly after this time the banking crisis and recession hit and the UK and international property markets ended up in dire straits.

Since then however, demand for good buy to let property opportunities has started to rise and now is proving to be a good time to get your hands on a great investment deal.

If, like a lot of people, you are excited about the prospects of what the buy to let investment sector can do for you – now is most definitely the time to get stuck in.

But, even though you may be eager to get your buy to let property portfolio officially up and running, you should bear in mind that you will need to follow certain tried-and-tested guidelines if it is all to go swimmingly.

Buy to Let Rental Yields

Firstly, you should remember that when investing in residential buy to let property you need to invest more for rental yields, not capital gains.

This is because over the next few years, returns on residential property are more likely to be created by yield and not capital gains.

You also need to take into consideration any other additional costs, such as repairs and maintenance works, letting and property management fees, property insurances, and add this to your starting budget.

Buy to Let Mortgages

It is also recommended that you try to mortgage your buy to let property at the highest loan-to-value (LTV) possible.

The main reason for this is that it is considered the best way to gather optimum returns for your own cash.

As a general rule, LTVs are around 75 per cent, although as market conditions improve they have been known increase to as much as 80 per cent and higher for investors with a good credit history, so make sure you are aware of these finance rates and build these into your investment calculations.

Buy to Let Investors Check List

Finally, if you are clear in your mind that investing in buy to let property could do a lot for your financial prospects, don’t waste time – get researching and make the first move now.

At the same time, it is important to ensure that you seek to reduce your investment risk and so increase your chances of success by taking in to account the following: