Property Ownership & Asset Diversification

Property Ownership, Investment Risk & Asset Diversification

Expert property training courses and practical workshops.

Investment Property Partners is a leading property investment and property training specialist. Our property investment experts have developed a comprehensive series of insightful, hands-on property training courses and practical workshops designed specifically for property investors, property developers and finance professionals.

This specialist property investment training course examines issues around property ownership, property investment risk management and asset diversification including direct and indirect property ownership models and what this means to an investor.

The training course examines the process of securitisation of real property assets, property derivatives and the opportunities they present for investors; and concludes with an in-depth review of property investment risk management and the application of portfolio theory and asset diversification.

This in-depth property investment training course is supported by a number of case studies and practical exercises that help to demonstrate and reinforce the course material in a practical context.

What Candidates Will Learn

On completion of this property training course candidates will have the knowledge and practical skills to:

Interested In Property Training?

If you’d like to learn more about our professional property training courses, including this course on property ownership, property investment risk management and asset diversification, or if you’d like to discuss your specific training requirements in more detail please contact us today:

Who Should Attend?

This specialist property investment training course has been developed for those interested in maximising the current and future market opportunities associated with property investment both in the UK and internationally.

Private individuals and corporate property investors, property professionals, financial advisors and wealth managers will gain significantly from this and our other property training courses.

Training Course Content

This specialist property training course covers the following:

Alternative routes to property ownership

- An introduction to the different types of property based assets.

- Direct and indirect property investment models compared.

- A review of the types of indirect property investment vehicle available.

- Investment funds and trusts and how they operate.

- Understanding the structure of different types of property company and their performance objectives.

- Understanding the securitisation process for real property assets.

- Securitised investment vehicles.

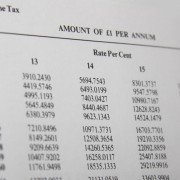

- Review of tax efficient investment vehicles.

- An introduction to Real Estate Investment Trusts (REITs).

- An international perspective.

Property derivatives

- An introduction to property derivatives and the opportunities they present.

- A review of the main types of property derivative currently available.

- Property Index Notes.

- Total Return Swaps.

- Forwards / Futures.

- The advantages and disadvantages of property derivatives.

- A review of current market conditions and product availability.

- A perspective on the development of future derivatives products.

Understanding property investment risk management

- An introduction to managing the risks associated with property investment.

- Identifying the risks and how to manage them.

- Risk evaluation through computer modelling.

- How to develop robust risk management strategies.

- Practical risk management tools.

- Market transparency and accountability through the Investment Property Databank (IPD) and other recognised sources of market intelligence.

- A perspective on popular international and emerging markets.

Portfolio analysis & diversification

- An introduction to portfolio analysis and the benefits of asset diversification.

- Typical characteristics of a diversified investment portfolio of assets.

- Diversification and the “Risk – Return” trade-off.

- Portfolio performance evaluation.

- The role of real property assets in a diversified portfolio.

- A review of current market trends.

- A perspective on international portfolio structures.

Training Course Duration

One day.

Expert Property Training & Workshop Solutions

As leading independent property investment specialists Investment Property Partners offer expert advice and support to clients across our specialist areas of expertise helping them to achieve their investment objectives.

If you are a property investor, property developer, financial advisor or wealth manager and want to improve your skills in areas associated with around property ownership, property investment risk management and asset diversification contact our property training team today to discuss how Investment Property Partners can help you.

You may also be interested in…

Further reading…

More information about property and real estate investing… here →