Financial Leverage, Gearing & Property Investment – Property Investors Guide

Financial leverage as a technique is a very powerful financial tool that many successful real estate and property investors use to great effect in their investment dealings. Financial leverage is a term that you will hear regularly whilst actively investing in property. So, what exactly does it mean, how does it work, and how can property investors use it to their advantage?

What is Financial Leverage?

Put simply, financial leverage is a method of utilising borrowed cash in the form of a loan or mortgage, to supplement non-borrowed money or your personal cash/savings/equity, in other words.

When we consider financial leverage in a property investment context, it is important for any ambitious investor to really understand the complexities of leverage because it is not only inevitable that you’ll come across it, but it can also be a very useful financial technique to use as part of your investment strategy.

One of the reasons for its desirability is the fact that it enables a property investor to increase their total property holdings several times over using a combination of both their own cash/equity plus additional property finance from other sources.

This multiplier effect is one of the fundamental aspects to financial leverage in property investment, and one that when used correctly can be a very powerful tool indeed.

There are also other more case specific reasons why it may prove advantageous.

Property Investment & Financial Gearing

With financial leverage also comes the term “gearing” which you may or may not have heard of.

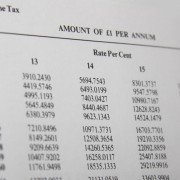

Gearing refers to the specific ratio of debt to equity and is vitally important when it comes to weighing up options and establishing whether the property you’ve found is really a sound investment.

Investing in Property

When it comes to asset investment in general, property or real estate has historically shown itself to be one of the best ways to do well – but only if you are wide-awake to the opportunities, the risks and what you need to do to succeed.

Property is a unique form of investment and one that can bring many rewards for the prudent investor.

However, there are also many pitfalls to catch the unwary, especially if you underestimate the level of research and effort involved… it is certainly not for the lazy or fainthearted.

Underlying Property Asset Values

One of the real benefits with property investment is that even if the property remains unoccupied for an unexpected amount of time, the finance lender will always be able to rely on the land value as their security, as land will always have value.

Many other types of investment asset do not really have this kind of safety net.

Property Investor Risk

For the serious property investor who’s prepared to put the time and effort in to researching their market, searching out the best opportunities and appreciating and managing their risks, investing in property really can bring excellent rewards.

Finally, a thorough understanding of the benefits of the basics of financial leverage and gearing, and how to use them to your advantage is also very important if you wish to improve your chances of becoming a successful property investor.

Specialist Property Finance Solutions

As a leading independent property investment specialists Investment Property Partners offer expert advice and support to clients across our specialist areas of expertise helping them to achieve their investment objectives.

If you are searching for property finance solutions please contact us today to discuss how Investment Property Partners can help you.

Further reading…

More information about financial leverage and gearing… here →