Peer-to-Peer Lending

Peer-to-Peer Lending & P2P Property Finance

Specialist peer-to-peer lending and property finance solutions.

Investment Property Partners is a leading independent property investment specialist advising clients throughout the UK and internationally. In addition to our property investment services we offer a range of complimentary property finance, peer-to-peer lending advisory, insurance and professional property support solutions.

Peer-to-Peer Lending

Peer-to-peer lending, often abbreviated to P2P lending is still a relatively new concept in the UK with some of the first firms offering this primarily Internet based service emerging in around 2005.

If you are frustrated by the super-low interest rates currently on offer from the banks for your savings, or you may have struggled to raise finance for that next property project, then you may have come across peer-to-peer finance already.

However, before you dive in and invest or look to raise finance via the peer-to-peer route it’s worth finding out the facts, how you can benefit and how you could potentially lose out.

Only then can you make an educated decision on whether or not peer-to-peer lending is right for you.

Interested in Peer-to-Peer Lending & P2P Property Finance?

If you’d like to learn more about our peer-to-peer lending, P2P property finance and investment capabilities and how we can help you, if you’d like to receive information about investment properties for sale, including the latest new developments and off-market investment opportunities, or if you’d like to discuss your requirements in more detail please contact us today:

What is Peer-to-Peer Lending?

Peer-to-Peer lending is also known as crowd-lending, social lending or lend-to-save, and it uses the internet to cost effectively connect investors with borrowers to create a real “win-win” solution for everyone.

It provides investors with an opportunity to invest their money directly with an individual or business that is looking to borrow without using a bank, building society or other financial institution.

What you first need to remember though is that this type of peer-to-peer investment is very different from your average savings account.

You invest your money via a website that offers peer-to-peer finance facilities, and there are several now online, with numbers growing all the time.

As such, many people are approaching P2P as another option to help them save money and get a better return on their investment.

What’s the Idea behind Peer-to-Peer?

No two peer-to-peer lending companies work in the exact same way, so it is wise to check the rules for each one before you decide to invest.

However, the idea is that an individual, business or property developer will use a P2P provider to get a loan, while the investor will use that same provider to facilitate the lending of money directly to businesses and individuals.

Those “peers” looking to borrow will have to complete a stringent series of checks before they can get the loan they want.

These checks are carried out to quantify and then minimise the risks associated with the borrower and their protect.

It is also likely that the peer-to-peer provider will look to match individual lenders to borrowers taking in to account both the anticipated risks and returns.

If you are an investor you have to decide how much you want to invest and how long for… generally speaking, this will be for a fixed period – perhaps one, three or five years, for example.

If all things go well you should, by the end of the investment period receive your initial deposit back, plus an amount in interest.

Peer-to-Peer Property Lending

If investing in property or development projects is for you then look out for peer-to-peer property specialists, rather than the more generic type of P2P provider.

Peer-to-peer property specialists are also more likely to secure loans against property, which lowers the investment risk but also the rate of return you receive.

Advantages & Disadvantages of Peer-to-Peer Lending

The main advantage of peer-to-peer lending is the prospect of earning significantly more in interest than you would if you deposited your money in a traditional bank or building society savings account.

Check each website to see what the likely rates of return and typical investment periods could be.

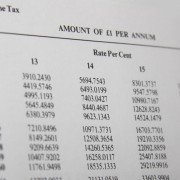

Currently, typical rates of over 5% can be achieved, depending on the peer-to-peer provider and the length of the investment term (easy access, 3 and 5 years).

You can also usually invest quite small amounts – you don’t need hundreds or even thousands of pounds to invest… with some providers requiring an entry level minimum of just £10.

Moving on to disadvantages, it is wise to remember that despite the introduction of additional protection and industry regulation by the Financial Conduct Authority from 1 April 2014 your money is still not protected in the same way it would be at a bank or building society.

If the company goes under, you could lose everything you invested.

Most reputable peer-to-peer firms have methods in place to protect against loss and to minimise risk.

However, there is still the chance that a glut of bad debts occurring at the same time could lead to a loss for investors.

Is Peer-to-Peer Right for You?

Peer-to-peer lending should not be used as your first port of call for your savings.

However, if you are debt free, open to a degree of financial risk and you fully understand what is being offered to you, you may be happy to help property investors, real estate developers, small businesses and even individuals, and to get a potentially-higher rate of interest as well.

One final point – do compare different peer-to-peer providers, their areas of expertise and consider the pros and cons before investing your money.

Specialist Peer-to-Peer Lending Solutions

As a leading independent property investment specialists Investment Property Partners offer expert advice and support to clients across our specialist areas of expertise helping them to achieve their investment objectives.

If you are a property investor or developer looking for property finance solutions including peer-to-peer lending and finance opportunities please contact us today to discuss how Investment Property Partners can help.

You may also be interested in…

Further reading…

More information about property finance and peer-to-peer lending for investors, real estate developers and contractors… here →